Steady Growth in spite of an Uncertain Economic Atmosphere

The APEC region needs to navigate an economic landscape marked by a complex blend of relatively stable growth and intensifying challenges.

Stable GDP growth with a cautious outlook

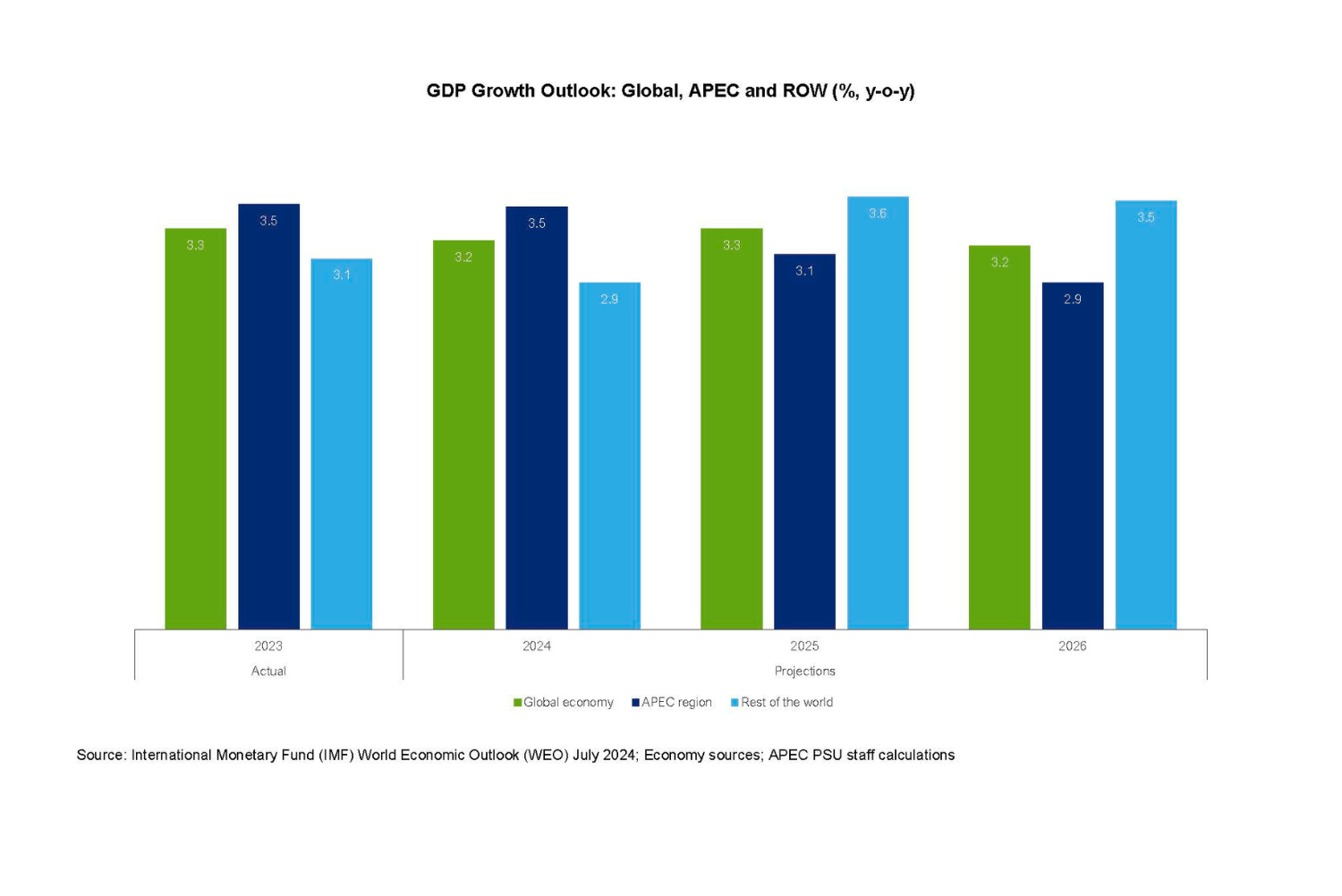

APEC’s GDP growth is anticipated to hold steady at 3.5 percent in 2024, mirroring last year’s pace. While a slight deceleration is projected for 2025, with growth expected to ease to 3.1 percent, this forecast represents a modest improvement from the 2.9 percent growth initially projected by the APEC Policy Support Unit in the May 2024 APEC Regional Trends Analysis report. Economic prospects have improved as inflation is falling due to a combination of appropriate monetary policy action and moderated food and energy prices. While all APEC economies are set to expand in the near term, the pace will vary across the region. Monetary policy action and moderating inflation

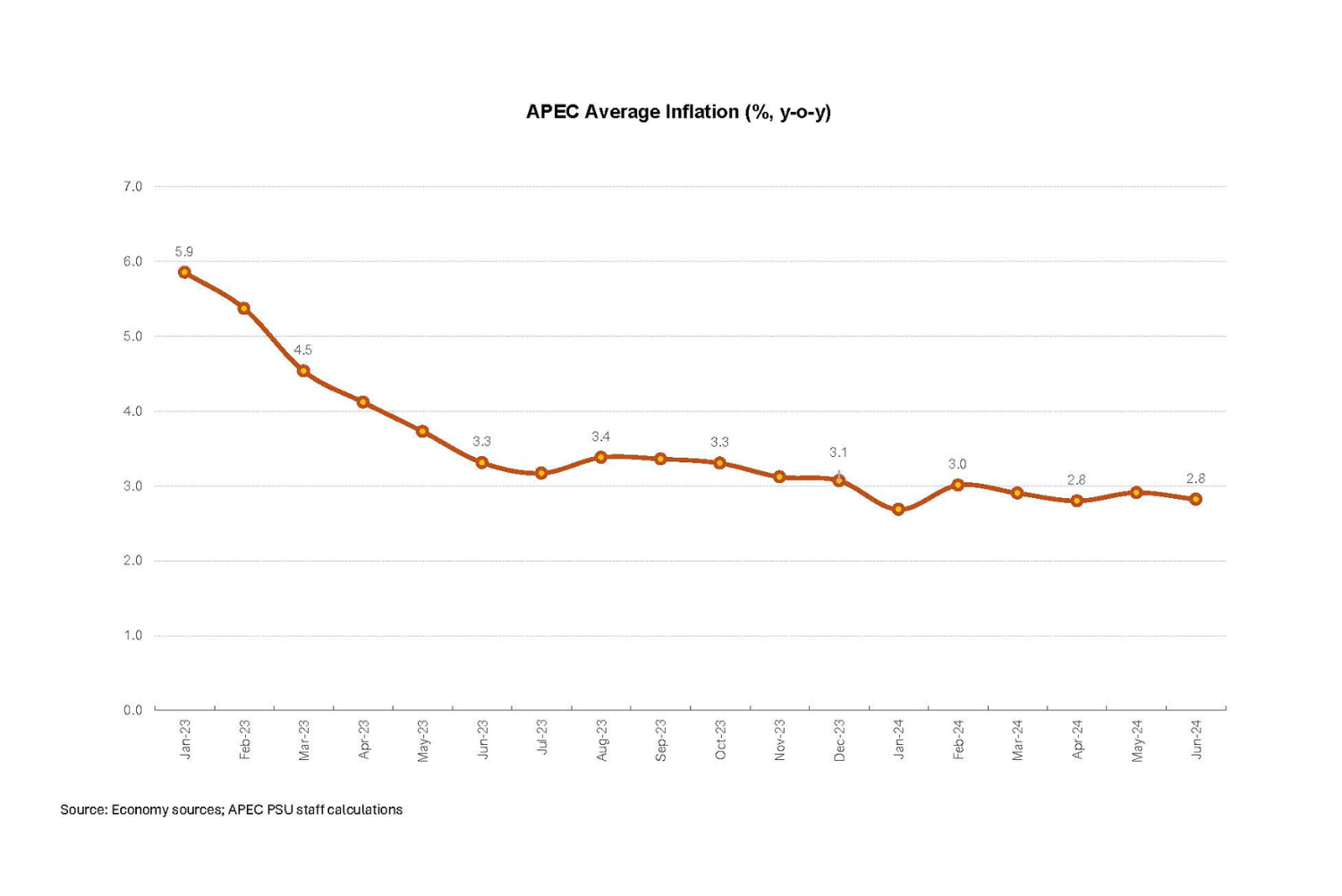

Monetary policy action and moderating inflation In APEC economies, inflation has moderated to 2.8 percent in June 2024 from 5.9 percent in January 2023 and 3.3 percent in June 2023. This downward trend reflects the effectiveness of monetary policy actions taken to stabilize prices.

In APEC economies, inflation has moderated to 2.8 percent in June 2024 from 5.9 percent in January 2023 and 3.3 percent in June 2023. This downward trend reflects the effectiveness of monetary policy actions taken to stabilize prices.

Central banks across APEC have largely maintained their policy stances, opting for a wait-and-see approach to conduct monetary policy adjustments. Too early and too drastic rate reductions could potentially widen the interest rate differential with the US Fed rates, risking capital flight and currency depreciation. Nonetheless, in recent months, 20 currencies in the APEC region, in general, have either appreciated or slowed their depreciation against the US dollar. Between April 2023 and April 2024, these currencies had depreciated by an average of 5.4 percent as measured against the greenback. In comparison, as of July 2024, these 20 currencies depreciated by an average of 3.9 percent against the US dollar over the past year, with 17 currencies experiencing declines between -0.7 and -12.4 percent, while three saw appreciation.

The relative stability of food and oil markets have helped contain inflationary pressures. The recent dip in cereal prices due to favorable weather conditions leading to larger harvests has provided some relief. In addition, production cuts in OPEC+ economies have been balanced by increased output from non-OPEC+ economies. Nevertheless, this equilibrium is fragile and continuous monitoring of oil inventories, alongside global economic conditions and geopolitical development is essential to determine oil price trajectories.

Resilient domestic consumption and economic optimism

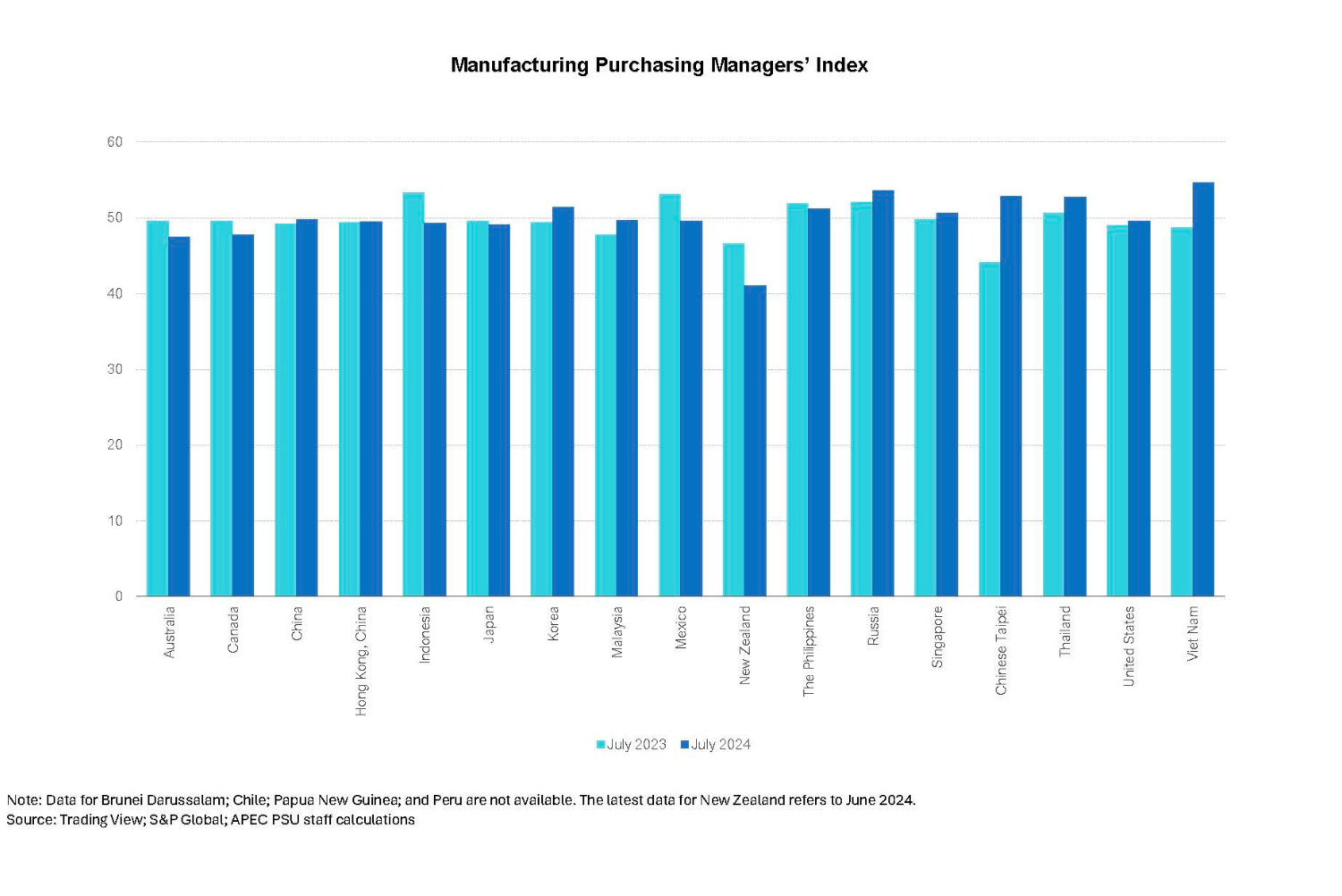

Positive economic signals are emerging, bolstered by a recovery in domestic consumption and stronger export performance. The Manufacturing Purchasing Managers’ Index (PMI), which measures the views of supply chain managers regarding manufacturing trends has stayed relatively steady, which indicates encouraging business conditions across several APEC economies. Challenges amid brighter short-term prospects

Challenges amid brighter short-term prospects

Despite these buoyant conditions, significant uncertainties cloud the short-term outlook. While transit across the Panama Canal is expected to increase as water levels are recovering, the ongoing conflict in the Red Sea has led to a renewed increase in freight costs, peaking in mid-July 2024 after a brief decline in April. Longer journeys to transport merchandise, coupled with port delays that extend up to 31 days in some key locations, further exacerbate these issues.

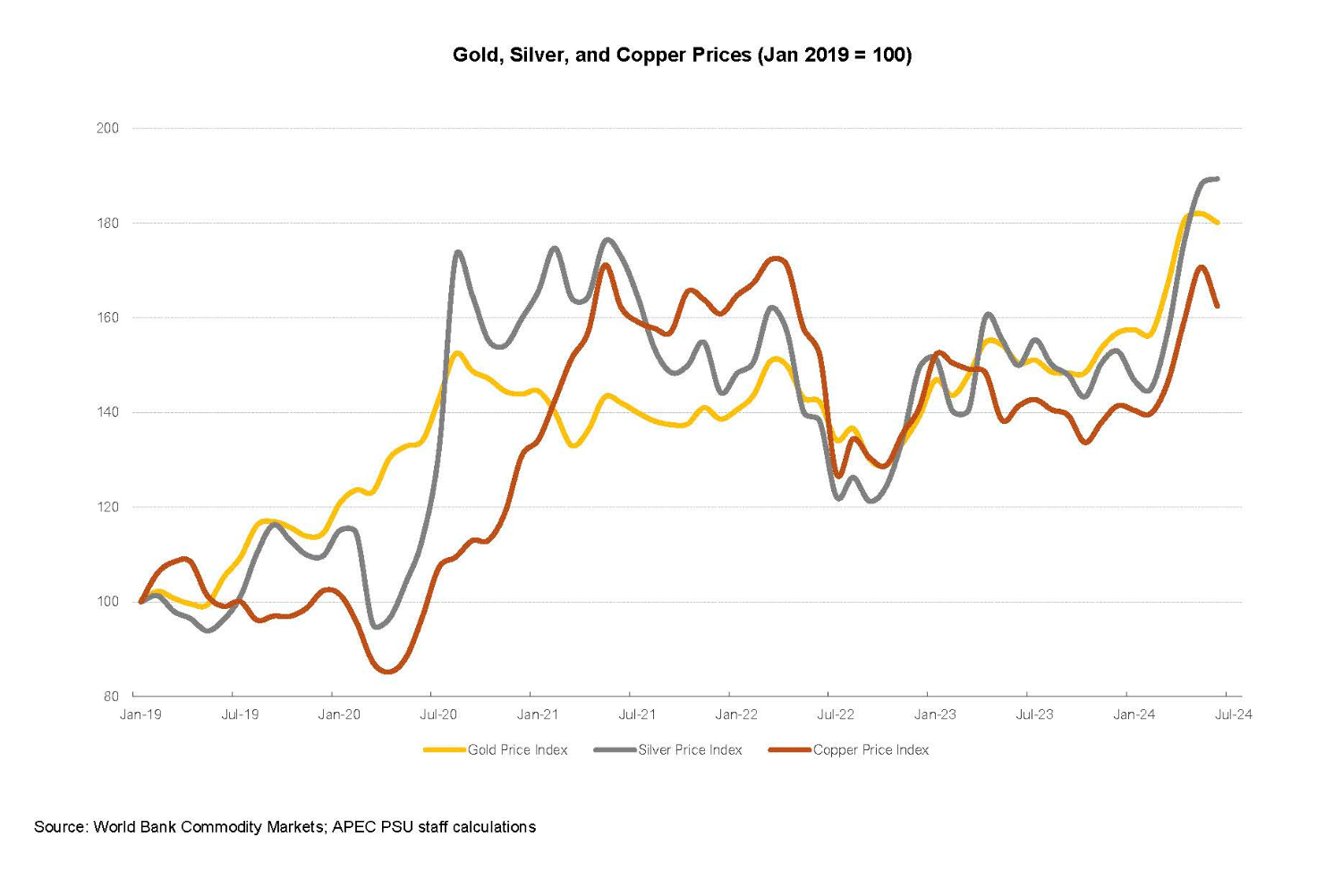

In addition, investors continue to hedge against global uncertainties, contributing to a rise in gold and silver prices. Copper prices have also surged due to its critical role in low-emission technologies, including electric vehicles and renewable energy, as well as increased demand driven by AI technologies and new data centers. Trade performance and geopolitical tensions

Trade performance and geopolitical tensions

Trade in APEC expanded in Q1 2024 compared to the same period in 2023, buoyed by global demand. Merchandise exports grew by 3.9 percent in volume and 1.6 percent in value, with imports also showing improvements. This trade performance aligns with the expected global trade volume rebound of 3.1 percent in 2024 and 3.4 percent in 2025.1

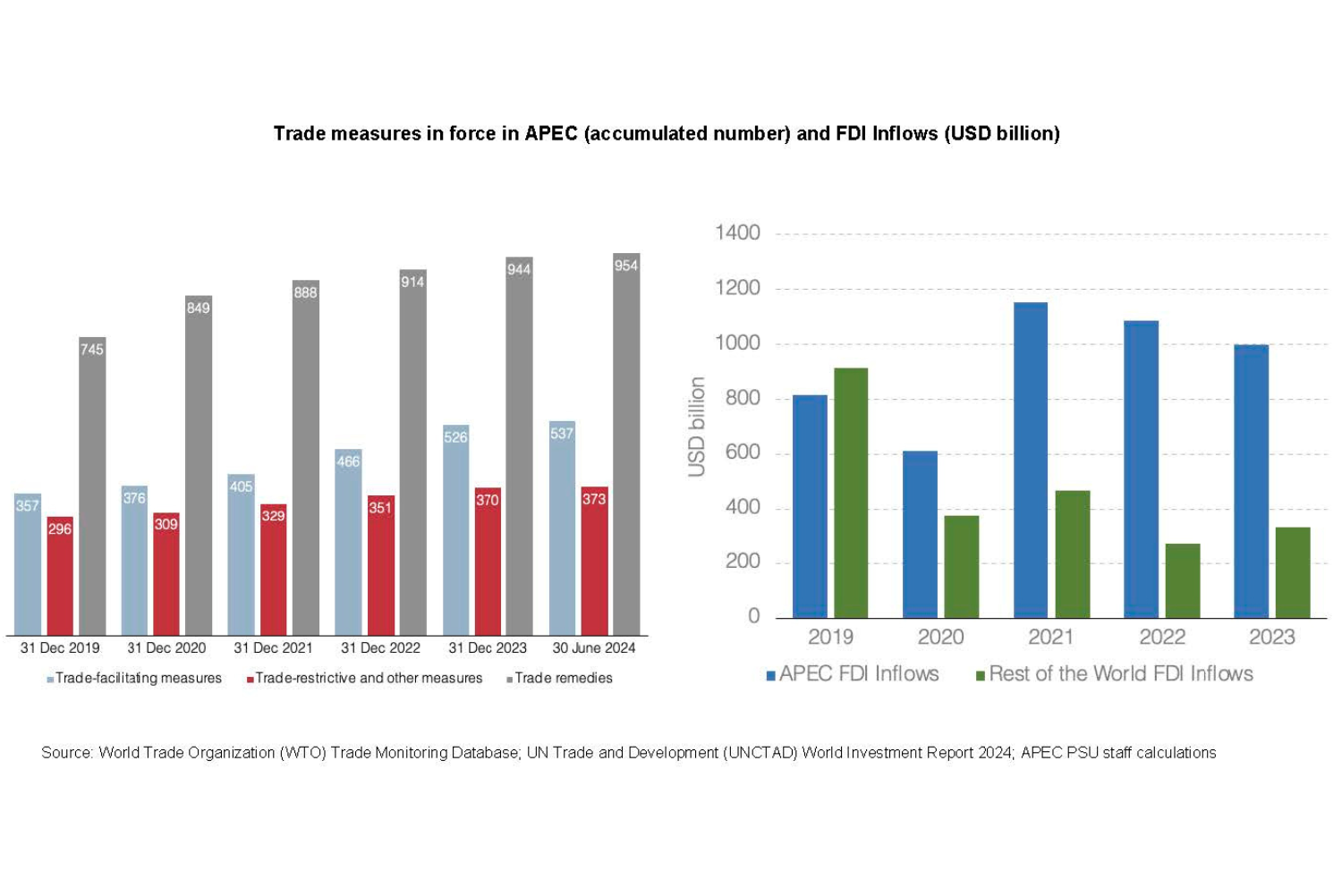

However, increasing trade restrictions and other trade remedies reflect growing geo-economic fractures affecting APEC members. The impact of these tensions also extends to foreign direct investment (FDI) flows. In 2023, APEC FDI inflows fell for a third consecutive year, declining by 7.9 percent, while outflows fell by 6.3 percent, contrasting with a 2 percent global FDI reduction.

APEC’s role in navigating global challenges

Implementing strategic economic policies, combined with leveraging APEC’s strengths as a regional economic forum, is key to navigating global challenges. APEC economies should avoid premature monetary easing, opting instead to adjust policy rates gradually as necessary. It is also essential to rebuild fiscal buffers and meet consolidation targets where feasible.

1IMF WEO July 2024

Effective economic policymaking requires exploring options that enhance trade relations, and achieve policy objectives through policy alternatives that do not restrict trade and investment. APEC’s role should be emphasized as a catalyst for innovative policy frameworks and collaborative strategies to address complex regional and global issues.

***

Rhea Crisologo Hernando is analyst, Glacer Niño A. Vasquez is researcher, and Carlos Kuriyama is director at the APEC Policy Support Unit.

For more on this topic, download the latest APEC Regional Trends Analysis report.